The Publisher’s Programmatic Survival Guide

With economic recession headwinds blowing across a majority of markets around the world and an impending cookiepocalypse, publishers are running out of time to clean up or transform.

In fact, Adweek recently spoke to 10 premium publishers about how the economic recession has impacted them, with 90% receiving negative impact from the recession - from a single affected campaign to a 20% year-on-year decrease in advertising revenue.

Online publishers have in recent times explored additional ways of monetization, from developing paid subscription offerings to affiliate programs, causing changes internally in how they operate. Longer-term implications for the media industry include intensified competition between publishers, as contention with their peers will then rest on gaining direct dollars from a single user.

In this new world, there are however still merits to digital ad revenue and the data a publisher holds if, and only if, publishers can grasp this immense opportunity to reinvent themselves.

The window is closing to successfully navigate this impending future, but the silver lining is that the foundational infrastructure has already been implemented on most, if not all, publishers here.

Maximization of demand

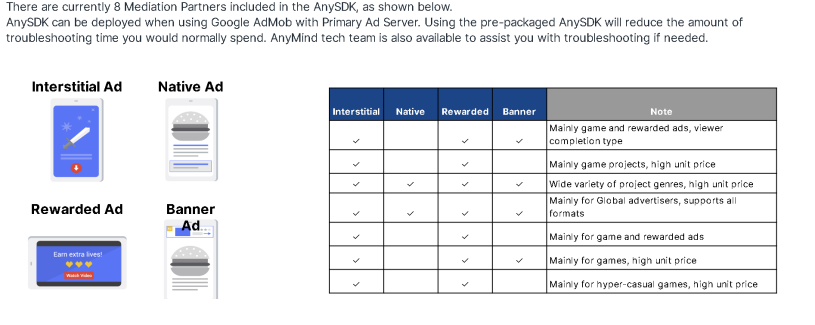

The saying: “Strong individually, but powerful together,” is all the more relevant in this context. Publishers today have the ability to tap on multiple DSPs, ad exchanges, and ad networks, identify the best-performing demand sources, and set up PMPs and header bidding. In fact, publishers do not even have to be limited to a single SSP.

Once fill rate is maximized, publishers can also look to open up new inventory. A fresh look at UI and UX will help a lot, and also an understanding and implementation of the ever-increasing types of ad formats can bring about new possibilities to increase inventory.

This can then build on current newsroom and content production resource, enhancing the value of each piece of content produced. However, publishers do not necessarily have to be limited to just this, bringing me to my next point.

Expanding content and advertising touchpoints

Publishers today have more ways to expand on their content, depending on where they look to. A perfect example of this is New York Times, expanding their content portfolio to include podcasts, newsletters, cooking recipes and games.

Publishers today have more ways to expand on their content, depending on where they look to. A perfect example of this is New York Times, expanding their content portfolio to include podcasts, newsletters, cooking recipes and games

Games is an area that publishers can focus on - with New York Times acquisition of Wordle bringing “tens of millions of folks” into their audience. Here, there are opportunities for publishers to add already-developed libraries of games onto their site, which helps to increase users and traffic, dwell times and ad inventory without having to increase manpower resource.

Another area of focus is in increasing video content. With the array of distribution channels and monetization options, developing and implementing video content on a site provides new instream advertising opportunities, and video content can also be repurposed and monetized on distribution channels such as social media. In addition, other ad spaces on the site can also be opened up to video ads. With higher CPM rates in general and increased spends on video advertising, having a site that is video-friendly and includes original video content will provide publishers with access into the video-consuming generation.

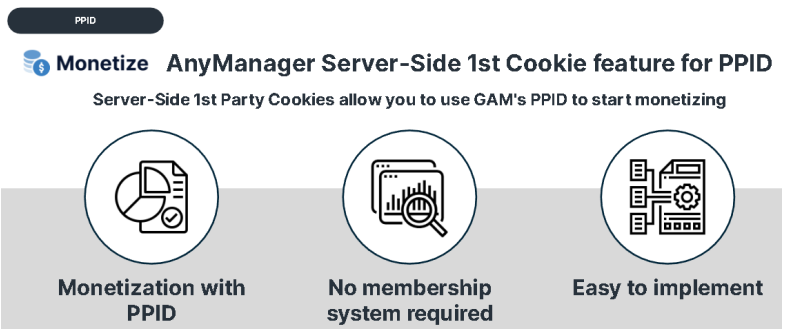

It’s all about the data

I’ve kept the best for last. One of the greatest assets of a publisher is first-party data, and although this value was not maximized in Advertising 2.0, it is crucial for the next stage of advertising. From setting up a consent management system to leveraging on this data to contextually target users, publishers might have this infrastructure ready now, but this is a need to have for the future.

With third-party cookies deprecating, audience ID solutions have risen in importance over the past couple of years - especially on the supply side. This is the new fuel for audience targeting. The gamut of ID solutions is also encouraging, providing publishers with a variety of methods to implement and grow their first-party data. Depending on the ID solution(s) implemented, publishers that have already developed logins on their site can also leverage this, and those who have not can tap on other types of ID solutions - that’s just how wide the range of solutions is.

In fact, what we’re seeing is a shift in power towards the supply side, with the currency for digital advertising changing hands to the ones who hold the inventory.

Ultimately, we will see a slow and gradual adjustment for publishers not just in this region but also all around the world. Those who move first will definitely have an advantage. The question is, are you ready

Click here to view the full synopsis in pdf version

Author: Ben Chien, Managing Director, AnyMind

Please address any questions or comments about this blog to

Alvina Chan, Secretariat Office, IAB (Hong Kong) - alvina.chan@iabhongkong.com